Silver for Financial Preparedness: Diversify your Emergency Fund

Should silver be part of your financial preparedness strategy? How can you use silver to help diversify your emergency fund? What kind of silver should you buy, and why? Where is the best place to buy silver?

These are some of the questions I’ve been asking myself over the past few months, which led me down the path of learning about our monetary system.

I learned that our fiat dollars used to be backed by gold and silver, but are now essentially worthless pieces of paper. (Did you know that dollar bills used to be silver certificates?? Instead of carrying around heavy silver, you could just carry dollar bills, which were redeemable at the bank for an ounce of silver).

And our circulation coins were at one time made out of silver, so the change we carried around in our pockets also had inherent value.

This is clearly no longer the case, so I wanted to explain why I feel that silver should play an important role in your financial preparedness strategy.

Before we begin, please note I am NOT a financial advisor, nor do I play one on this blog. Nothing I say should be construed as financial advice. I’m just sharing what I learned as I researched this topic for my family. As with all things pertaining to preparedness, everyone’s circumstances are different. Be diligent, do your own research, and draw your own conclusions.

What’s Rome Got to Do With It?

I started reading about the fall of the Roman Empire, and how their silver coins were debased over time. The denarius started off weighing about 4.5 grams, and was almost 100% pure silver. Over time, both the silver content, and the size of the coin were reduced, until by the 2nd half of the third century, the denarius was only about 2% silver.

The debasement of the Roman denarius was one of the factors that contributed to the fall of Rome.

This is effectively what the current governments are doing to our monetary system.

When Did Our Money Stop Having Value?

Here in Canada, up until about 1967, all our coins were made out of 80% silver, so they had actual value. After 1967, the government debased those coins, by making them out of cheap metals, and eliminating the silver content altogether.

I believe the US phased silver out of their coinage a few years earlier – around 1964.

At this point, the only reason our dollars have value, is because the government says they do. (Try holding a stack of bills behind your back – can you tell the difference between a hundred dollar bill and a five dollar bill?)

Unlike silver, which holds inherent value due to its beauty and usefulness, our dollar bills and coins have ZERO inherent value. Our coinage is no longer made of silver, and our ‘paper’ (now plastic) money is no longer backed by silver or gold.

How Does Inflation Work?

The government can essentially create ‘money’ out of thin air, by loaning out money they don’t have – and the more money they create, the less it is worth. I used to think that inflation meant that prices were increasing. Now I realize it’s simply the value of the dollar decreasing. The more money that is created, the less value it holds, and the more of it you need to buy stuff.

The average annual rate of inflation since 1914 in Canada, is 3.2%. A dollar will lose half of its value in just 35 years. The Canadian dollar lost more than 94 per cent of its value between 1914 and 2005. (Source: The Bank of Canada).

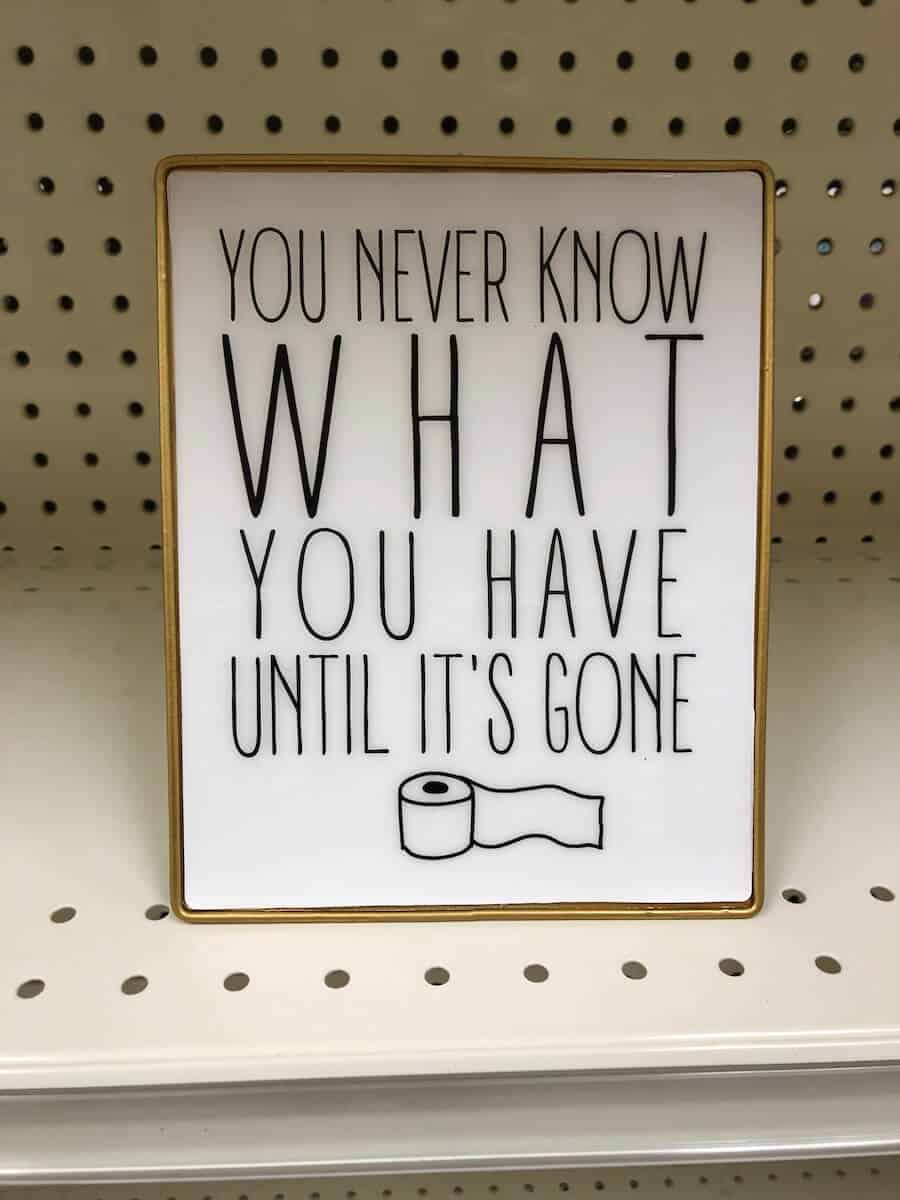

With the government currently printing money like it’s toilet paper, high inflation is inevitable. I feel it’s a wise time to start trading some government paper money for real money: silver.

After doing tons of research, I bought my very first pieces of silver. And let me tell you, I had no idea how different it would feel to hold a pure ounce of silver in my hand. Real money.

Silver has been used as money for thousands of years, so holding it made me feel like I was holding a piece of history.

Why Buy Silver for Financial Preparedness

1. It’s important to diversify your emergency fund.

The general consensus is that everyone should have 3-6 months of expenses saved in the bank. This money should not be invested, but rather sitting liquid in a savings account. The purpose of this account is an emergency job loss fund – if you were to become seriously ill or injured, or lose your income for a period of time, this fund would help get you through until you get back on your feet again.

At one time, the banks actually paid interest for letting you store your money there, so that they could loan it out to other people and make money with it. However, most banks are currently paying less than 1% interest, if anything at all. So they’re loaning out your money to other people, and you’re not getting a cut. You’re essentially loaning them your money for free.

The other problem, is that inflation is actually eroding the value of your money the longer it sits in the bank. You want it liquid for emergencies, but you also don’t want it losing value while it sits there. While it may appear that the amount of money in your account is the same, or even a few cents higher if you’re lucky enough to earn a tiny bit of interest, the truth is, inflation is stealing your money.

Keeping some of your emergency funds stored at home in the form of silver is an excellent hedge against inflation.

While it’s *slightly* less liquid (you’d have to take it to a coin shop to trade it for cash), at least it’s not losing value, and there is even a chance it could go UP in value.

And trust me, your dollars have a 0% chance of ever going up in value. There is only one direction that fiat currencies travel, and that’s down.

2. In a financial crisis, you may not have access to your money in the bank.

Many of us have not seen this happen in our lifetimes, but if there were ever to be a huge financial crisis, you may not have access to the funds in your bank account. (If you haven’t heard of this, read about what happened with the banks at the start of the Great Depression).

I know many people believe that FDIC insurance protects you from losing your money, but the FDIC wasn’t designed for wide-scale financial disasters. In fact, the FDIC only has enough money to cover a small fraction of the funds that are on reserve at the bank.

Also, when you put your money in the bank, 2 things happen:

- It’s no longer your money (once you deposit your money in the bank, the bank now owns it)

- The bank only has to keep 10% of your money on reserve, and can loan out the other 90% (this is called fractional reserve lending).

In a wide scale financial disaster, the bank doesn’t have to give you your money back – they can actually keep it to repay their investors first.

Also, due to fractional reserve lending, they don’t actually have your money. They just have digits on a screen. They have loaned out 90% of the money you put in there. So if suddenly, everyone tried to take their money out of the bank at once, there wouldn’t be enough. The bank can declare a bank holiday (shutting their doors for a period of time), OR they can limit how much you can withdrawl in a day or a week.

During an emergency situation, this is obviously not ideal. This is why I feel it’s a good idea to not store ALL of your money in the bank.

You obviously don’t want to keep a ton of cash at home, so the bank is a safe place to store it, especially if it’s a large amount. However, I would recommend trading some of that money for silver so you can diversify your emergency fund, and be more financially prepared.

And when I say silver, I mean real, actual silver that you hold in your possession. Not digital silver in the form of ETFs. For preparedness reasons, you want physical possession of your precious metals.

3. You Can Barter with Silver

As more people learn the value of silver, it can become a bartering tool. Although I recommend keeping cash on hand as well, many people recognize the value of silver, and may be willing to trade goods for it.

4. Silver Helps Protect You Against Inflation

Unlike government dollars, silver is inflation-proof.

When silver goes up in price, what it actually means is that the dollar is losing value. Because it now costs more dollars to buy the same amount of silver. When you see the cost of silver rising over time, it’s because your dollar is worth less.

Yes, the price of silver fluctuates, but when you consider the buying power of silver 50 years ago compared to now, it’s almost identical. Meaning what you could buy with an ounce of silver in 1970 is effectively the same as what you can buy with an ounce of silver today.

For example, in 1918 in the USA, a gallon of gasoline was worth 20 cents, or 2 US dimes (which were made of 90% silver). In 2011, a gallon of gas was $5.00 a gallon, which is the equivalent value of 2, 90% silver dimes (which were also worth $5.00). Gas isn’t getting more expensive, currency is losing value. But silver maintains its purchasing power. (Source)

What Kind of Silver to Buy for Financial Preparedness

One of the benefits of silver, is that there are so many forms you can buy it in!

There are rounds, coins, bars, shot, and junk silver (junk silver is dimes, quarters, and half dollars that were made of a high % of silver until the mid 1960s). And each of these comes in a variety of weights and styles. It can actually be a little overwhelming when you’re first getting started.

I would recommend keeping it simple in the beginning, and just purchasing your sovereign country’s 1 ounce coin.

In Canada, it’s the Canadian Maple.

In the US, it’s the Silver Eagle.

Many sovereign countries will have their own one ounce coin, so do some research to find out what that is.

Here is why I suggest going with your country’s own one ounce sovereign coin:

- They are easy to find

- They are recognizable, all around the world even, making it an excellent way to store silver for preparedness reasons

- A sovereign coin is legal tender

- They are one troy ounce of silver, and smaller denominations would be more useful if you needed to use your coins to barter

- It’s illegal to counterfeit a sovereign nation’s minted coin, so there is very low risk of getting a fake

- For the above reason, you can buy or sell them at any coin shop

- They are beautiful to hold and look at

- Since it’s a minted currency, there is no tax when you buy it – because it’s money. You’re just trading one form for another.

Where to Buy Silver

There are 2 places I would recommend buying silver:

1. Your Local Coin Shop

First, I would suggest looking to see if there is a local coin shop in your area.

Getting to know your local coin dealer is an excellent plan, especially if you’re looking into silver for preparedness. You’ll want to build a relationship with your dealer, so that if the time comes that you need to trade some of your silver coins for currency, you’ll already have an established relationship.

Another reason to use a local coin shop, is because you can literally buy one coin at a time. When you’re first getting started with silver, it can feel a little overwhelming. I walked into my local coin shop and asked to buy one Canadian Silver Maple. He handed me the maple, and I handed him cash. It was that easy.

I prefer to shop with cash, which is another reason I like to purchase from our local coin shop.

If you’re new to stacking silver, you may not have a lot of money to invest. Having the option to buy just one coin at a time takes away the feeling of overwhelm.

Even if you just picked up one coin a month, after 12 months, you’d own 12 ounces of silver. That makes you 12 ounces richer than you were before you started.

Here in Canada, at the present time it costs about $40 to pick up one silver maple. (This, of course, varies with the current spot price of silver, plus the small premium you pay to the vendor).

$40 a month is a very affordable savings account.

Once you have your first coin, and feel the beautiful weight of real money in your hands, you’ll likely want to keep getting more.

2. Reputable Online Dealer

If you don’t have a local coin shop, or you prefer to shop online, my next recommendation would be a reputable online dealer.

I spent some time searching online forums to get an idea of what dealers came highly recommended. I also went to various dealers’ websites to see which ones had the lowest requirement for free shipping. You want to avoid paying shipping charges on your coins, because that effectively increases the cost of your coins when you buy them – a cost you won’t recoup if you need to sell them.

I chose to go with Silver Gold Bull.

In Canada, most places you need to spend $500 or even $1000 to get free shipping. With Silver Gold Bull, you only need to spend $300 to get free shipping.

We have ordered from Silver Gold Bull twice now, and both times, service was EXCELLENT, our order arrived quickly, and everything was neatly and securely packed.

If you live in the US, I’ve heard that SD Bullion is good, and the minimum for free shipping is only $99.00.

Silver as a Preparedness Tool

Have you considered trading some of your fiat currency for silver? I feel it adds an extra layer to financial preparedness by helping to protect you against inflation, and offer an alternate form of currency in the case of a complete financial collapse. It makes a wonderful at-home savings account, and helps you maintain a little bit of independence from the government and the banking system.

Silver is also beautiful, has inherent value, and once you hold some in your hands I think you’ll feel a historic connection to this form of money.

Other Posts Related to Financial Preparedness:

Digital Envelope Budgeting: An Old-Fashioned Budgeting Method for Modern Times